Ira contribution calculator fidelity

Find out which IRA may be right for you and how much you can contribute. However there is an additional exception.

Mobile Finance Fidelity

For couples the contribution is reduced starting at 198000 and phased out altogether at 208000.

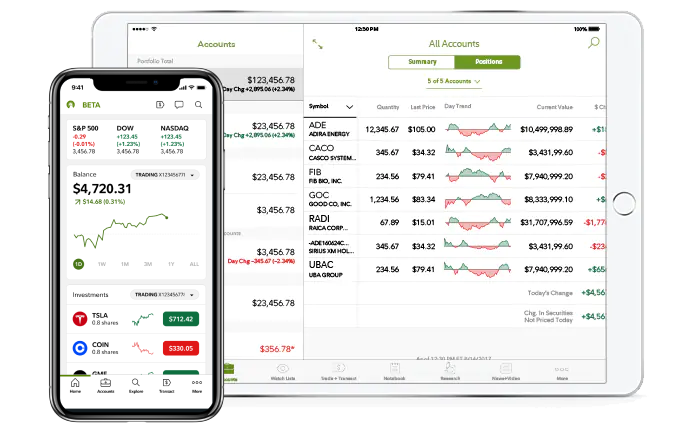

. Maxing out your annual Roth IRA contributions is one of the best ways to impact your retirement savings. Open a Roth IRA from the 1 IRA Provider Fidelity. That means youre obliged to withdraw a fraction of your IRA401k accounts around 35 in the first year and increasing slightly each year thereafter and pay income taxes on that amount withdrawn.

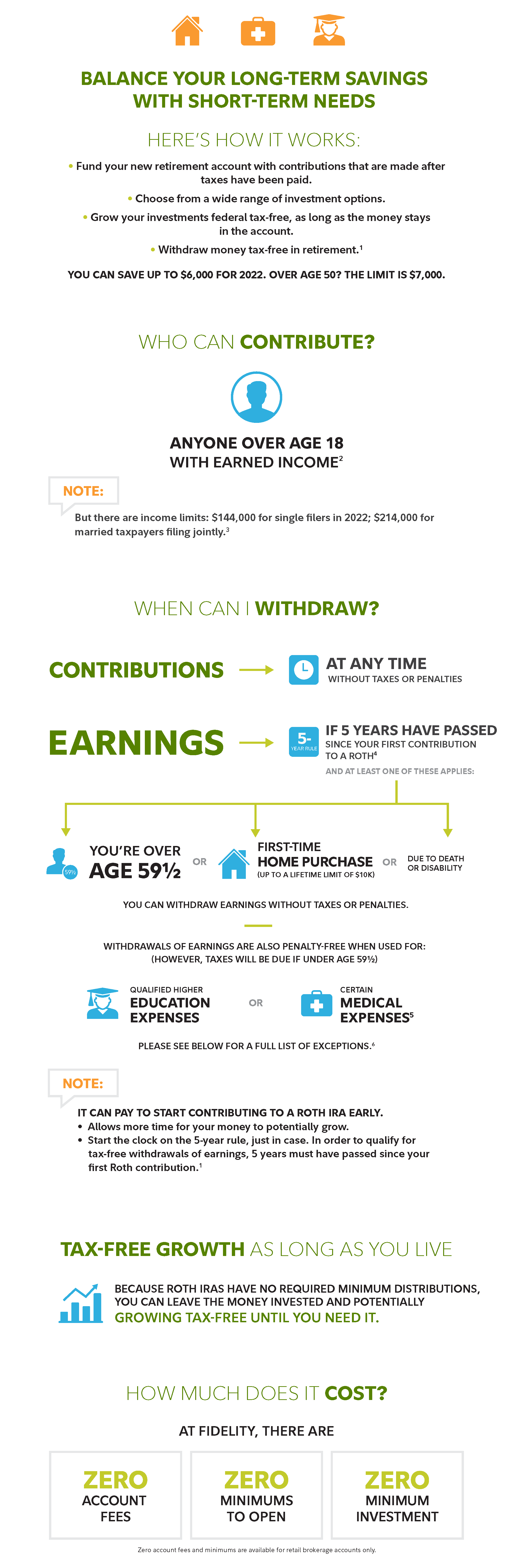

The phaseout range for an individual is 129000 to 144000. From tax advantages maximum contribution and fees here are some details that can convince you to consider a Roth IRA. For a Fidelity Go Roth IRA or Fidelity Personalized Planning.

Grow your savings and enjoy tax-free retirement withdrawals with a Roth IRA. Traditional IRA comparison page to see what option might be right for you. IRA investors will find a lot to love at Fidelity InvestmentsThe firms online brokerage platform offers a strong lineup of no-minimum-purchase mutual funds four zero expense ratio index funds.

For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. So thats an overview. The IRA contribution limit for 2021 and 2022 is 6000.

Heres more on the pros and cons of the IRA vs. The concept behind Roth IRA is that you make contributions to this account with after-tax moneyOnce you turn 59½ and have been in a Roth IRA plan for five years all distributions taken from the plan are tax-free. You can generally contribute up to 6000 or 7000 per year to a Roth IRA contribution limits vary by income and age and may change each tax year.

So if they earn 2000 for babysitting and walking dogs during the year. Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status. Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k.

One more considerationYour IRA401k money is subject to Required Minimum Distributions RMDs when you reach age 70-12. Converting to a Roth IRA may ultimately help you save money on income taxes. For the 2022 tax year.

If you overcontribute to your Roth IRA you can run into penalty taxes. Traditional IRA contributions are not limited by annual income. Partial contributions are allowed for certain income ranges.

Contributions cant be more than a child earns for the year. You can use our IRA Contribution Calculator or our Roth vs.

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

Fidelity Go Review Pros Cons And Who Should Set Up An Account

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Fidelity Go Review Smartasset Com

Contributing To Your Ira Start Early Know Your Limits Fidelity

Nine Compelling Reasons To Have A Roth Ira Roth Ira Roth Blog Content

Schwab Vs Fidelity Which Is The Better Stock Broker Investor Junkie

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

Save For The Future With A Roth Ira Fidelity

Fidelity Go Review Pros Cons And Who Should Set Up An Account

What To Do With An Old 401 K Fidelity Investments Investing Fidelity Money Management

Fidelity Go Review A Low Fee Robo Advisor Forbes Advisor

Fidelity Roth Ira Accounts For The Average Joe 2021 Youtube

Roth Ira Conversion Calculator Is A Roth Ira Right For You Calculators By Calcxml Roth Ira Conversion Roth Ira Conversion Calculator

Roth Conversion Calculator Fidelity Investments

/Untitled-72f62d8eef3c4d358da00b4c45645f34.jpg)

Fidelity Investments Review